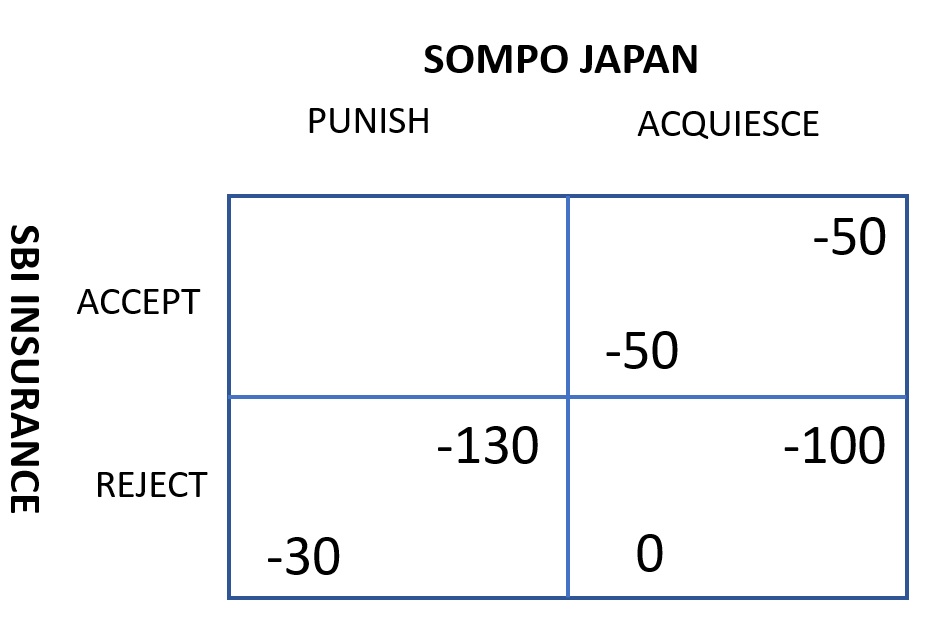

Let’s discuss the Japanese insurers’ payoffs using an Ellsberg matrix. Figure 1 shows payoffs of Sompo Japan (upper right of each cell) who insured the liable party and of SBI Insurance (lower left) who insured non-liable party. Let’s assume that the Sompo Japan customer is 100 percent liable but the company insists on 50/50 payoff. If SBI Insurance accepts (“ACCEPT”) Sompo Japan’s proposal, its payoff will be -50, and Sompo Japan will suffer only 50 too (upper right section), compared to -100.

Facing Sompo Japan’s demand, SBI Insurance (and its customer) has to consider to reject it and bring the matter before the court (“REJECT”). They may win and SBI’s payoff will be -30 (legal costs only), whereas Sompo Japan (and its customer) suffers 130 (lower left). Of course, Sompo Japan may choose to acquiesce in SBI’s rejection and choose -100 instead (lower right cell). Needless to say, the choice of acceptance or rejection by SBI will be heavily dependent on the likely course of the litigation and if the above figure is reasonably convincing, there is no incentive for SBI to accept the demand (and Sompo Japan knows it).

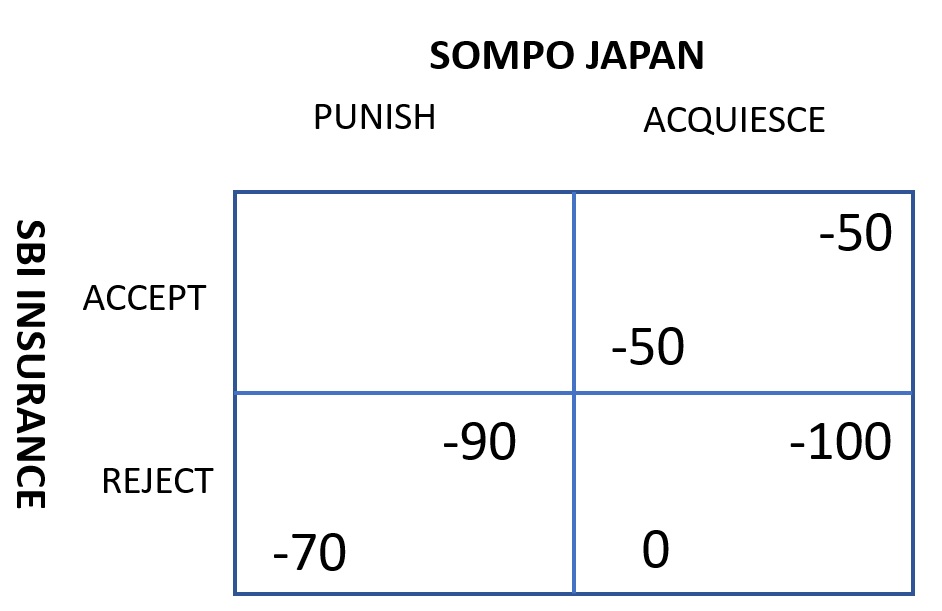

It’s not easy for the other insurer to make a choice however. Suppose that the court is not likely rule in the customer’s favor and enfoce the 60/40 split (Figure 2), then the best outocme for SBI is acheived when they “ACCEPT” the 50/50 split, because its payoff upon litigation will be -70 (-40 and -30 of legal fees). Realizing this, Sompo Japan will indicate willingness to litigate (the outcome of whcih is better than the rule), and both parties are likely to agree on 50/50 split (upper right cell).

Moreover, this is only of the many accident cases. Insurance companies handle tens of thousands of cases annually, and they are financially indefferent whether certain customers win or lose (read discussion in #1). Indeed, with 50/50 split, both insurers will enjoy the economic benefit or rasing the insurance premium for their customers. These mutually dependent structure naturally leads to collusive behavior.