Quite a few car liability insurance holders complain that their insurer suggests a “compromise” even when the driver is not to blame for the accident, while the insurer of the liable party almost always seeks to offset the claim of the victim. While these two phenomena may appear contradictory, they can be best explained as a product of collusion among insurers, which leads to unwarranted profits for them as well as to significant social moral hazard.

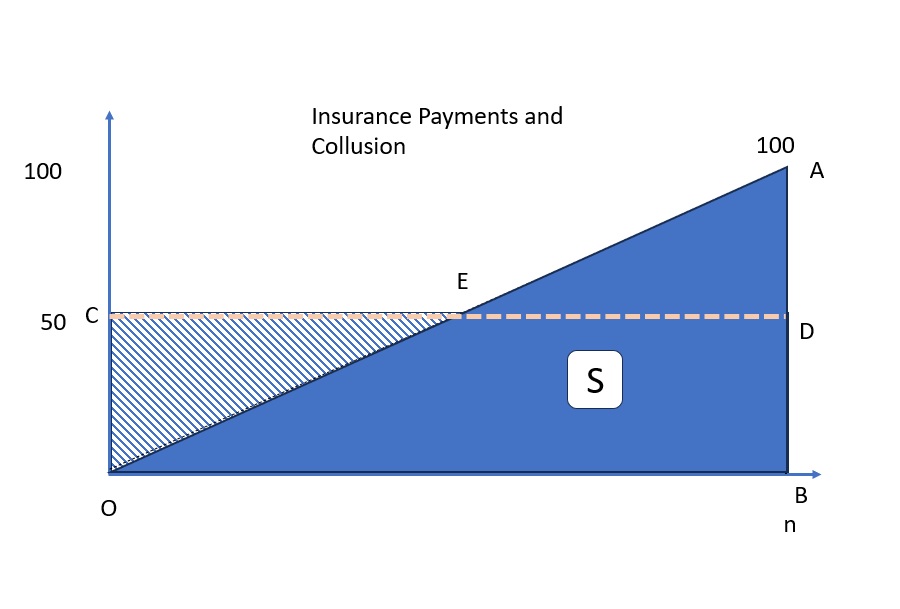

Let’s review the phenomenon using a simple diagram. Above is the conceptual distribution of insured motorists who caused accidents with the liability level of 0 (at “O”) to 100 (“n”th). Theoretically, the insurer should pay out for the covered damages corresponding to the level of liability. For example, the insurer is supposed to pay a full amount of damages for the motorist “n”,

This does not happen. Instead, insurers seek to “flatten” the liability level curvfe. Note that, across the n accidents oveall, the total amount of damage payments remains the same. If they succeed to reach agreement on a 50:50 basis for all accidents, the total amount will be the rectangle CDBO, which is equal to the triangle OAB, the threoretical payment amount strictly according to the liability level. This insurarer strategy is best explained by (i) insrers’ profit maximizing through cost reduction and (ii) colluison among insurers. (continued)